Focus on personal finance 7th edition kapoor – Focus on Personal Finance: 7th Edition by Kapoor embarks on a journey to unravel the intricacies of personal finance, equipping readers with the knowledge and strategies to achieve financial well-being. This definitive guide caters to individuals seeking to navigate the complexities of financial planning, debt management, investing, and retirement planning.

With a clear and engaging narrative, the book delves into the fundamental principles of personal finance, empowering readers to make informed decisions about their financial future. From budgeting and saving to investing and managing debt, Kapoor’s 7th edition provides a comprehensive roadmap to financial success.

Introduction

Personal finance is the management of an individual’s financial resources. It encompasses planning, budgeting, saving, investing, and managing debt. The 7th edition of Kapoor’s book, “Personal Finance,” is designed to provide a comprehensive overview of personal finance principles and practices for individuals at various stages of their financial lives.

The target audience of this book includes individuals seeking to improve their financial literacy, make informed financial decisions, and achieve their financial goals. It is particularly beneficial for students, young professionals, and anyone looking to enhance their understanding of personal finance.

Financial Planning Basics

Financial planning is the process of creating a roadmap for achieving your financial goals. It involves assessing your current financial situation, identifying your goals, and developing strategies to achieve them. The principles of financial planning include:

- Setting financial goals

- Creating a budget

- Saving and investing

- Managing debt

- Protecting your assets

Budgeting is the process of tracking your income and expenses to ensure that you are living within your means. Saving is the process of setting aside money for future goals. Investing is the process of using your savings to grow your wealth over time.

Managing Debt and Credit

Debt can be a useful tool for financing large purchases, but it is important to manage debt responsibly. Different types of debt include credit cards, student loans, and mortgages. Unmanaged debt can negatively impact your credit score and overall financial health.

Strategies for managing debt include:

- Creating a debt repayment plan

- Consolidating debt

- Negotiating with creditors

Building good credit is essential for obtaining favorable interest rates on loans and other forms of credit. Factors that affect your credit score include your payment history, credit utilization ratio, and length of credit history.

Investing for the Future: Focus On Personal Finance 7th Edition Kapoor

Investing is a way to grow your wealth over time. Different investment options include stocks, bonds, mutual funds, and real estate. The basics of investing include:

- Understanding risk and return

- Diversifying your investments

- Rebalancing your portfolio

Risk refers to the potential for losing money on an investment. Return refers to the potential for making money on an investment. Diversification is the process of spreading your investments across different asset classes to reduce risk.

Retirement Planning

Retirement planning is the process of saving and investing for your retirement years. Different retirement accounts include 401(k) plans, IRAs, and annuities. The importance of retirement planning includes:

- Ensuring a comfortable retirement lifestyle

- Reducing the risk of outliving your savings

- Maximizing tax savings

Tax implications and strategies for maximizing retirement savings include understanding the different types of retirement accounts, taking advantage of tax-deferred growth, and making catch-up contributions.

Insurance and Risk Management

Insurance is a way to protect yourself from financial losses due to unexpected events. Different types of insurance include health insurance, life insurance, and property insurance. The importance of insurance includes:

- Protecting your health and well-being

- Protecting your loved ones

- Protecting your property

Risk assessment is the process of identifying and evaluating potential risks to your financial well-being. Strategies for mitigating financial risks include purchasing insurance, creating an emergency fund, and diversifying your investments.

Estate Planning

Estate planning is the process of managing your assets and planning for their distribution after your death. Different estate planning tools include wills, trusts, and powers of attorney. The importance of estate planning includes:

- Ensuring that your assets are distributed according to your wishes

- Minimizing estate taxes

- Protecting your loved ones

Tax implications and strategies for preserving wealth include understanding the different types of estate taxes, using trusts to reduce taxes, and making charitable contributions.

Case Studies and Examples

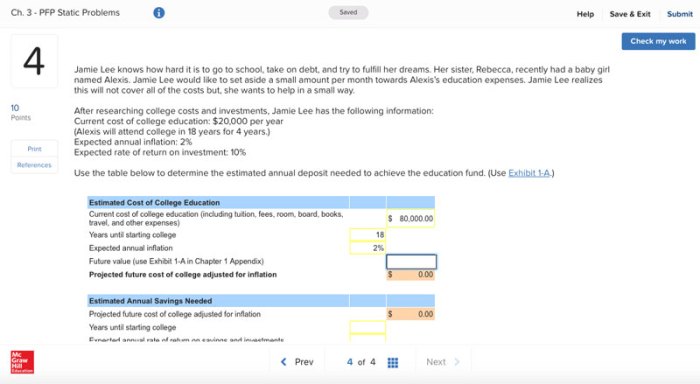

Case studies and examples are a valuable tool for illustrating the application of financial planning principles. Real-world examples of personal finance challenges and solutions can help readers understand how to apply these principles to their own lives.

Case studies can include individuals who have successfully overcome financial challenges, achieved their financial goals, or made poor financial decisions. Examples can include specific financial planning strategies, investment techniques, or debt management tactics.

Technology and Personal Finance

Technology has revolutionized the way we manage our personal finances. Different technologies include budgeting apps, investment platforms, and financial advisors. The role of technology in personal finance management includes:

- Simplifying budgeting and tracking expenses

- Making investing more accessible and affordable

- Providing personalized financial advice

Financial technology (fintech) companies are constantly developing new and innovative ways to help individuals manage their finances. These technologies can make it easier for individuals to save, invest, and plan for their financial future.

Ethical Considerations in Personal Finance

Ethical issues in personal finance include conflicts of interest, insider trading, and predatory lending. The importance of ethical considerations includes:

- Protecting investors and consumers

- Maintaining the integrity of the financial system

- Promoting responsible financial decision-making

Responsible investing is the practice of investing in companies that are committed to social and environmental responsibility. Financial decision-making should be based on sound financial principles and ethical considerations.

Essential FAQs

What are the key principles of financial planning?

Financial planning involves setting financial goals, creating a budget, managing debt, investing, and planning for retirement.

How can I effectively manage debt?

To manage debt effectively, consider consolidating high-interest debts, exploring debt settlement options, and seeking professional credit counseling if necessary.

What are the basics of investing?

Investing involves allocating funds to various assets such as stocks, bonds, and mutual funds to potentially generate returns and grow wealth.

Why is retirement planning important?

Retirement planning ensures financial security during retirement years by saving and investing early, maximizing retirement accounts, and considering additional income sources.

How can technology simplify personal finance management?

Technology offers budgeting apps, investment platforms, and financial advisory services that streamline financial tasks, provide insights, and enhance decision-making.